Some Ideas on How Long Can Children Stay On Parents Insurance You Should Know

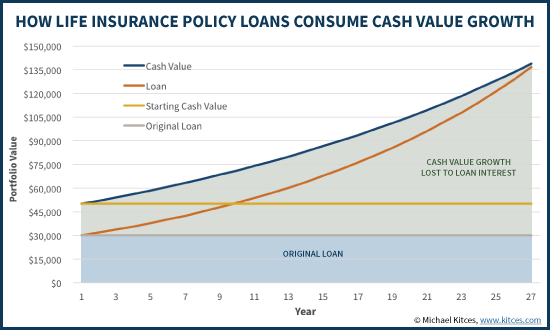

Believe you may want permanent life insurance however can't manage it. A lot of term life policies are convertible to irreversible coverage. The deadline for conversion differs by policy. Think you can invest your money much better. Buying a cheaper term life policy lets you invest what you would have paid for a whole life policy.

In 2020, estates worth more than $11. 58 million per individual or $23. 16 million per couple go through federal estate taxes. State inheritance and estate taxes differ. Have a lifelong reliant, such as a https://web.nashvillechamber.com/Real-Estate-Agents-and-Brokers/Wesley-Financial-Group,-LLC-21149?utm_source=GoogleSearch&gclid=Cj0KCQjw3s_4BRDPARIsAJsyoLMcbna5tFxdH9g--Y2UQliNiFGTrCXy6AAE6S9tZYYYuTspQQTsWakaAptfEALw_wcB child with special requirements. Life insurance coverage can money an unique requirements trust to provide care for your child after you're gone.

Wish to spend your retirement cost savings and still leave an inheritance or money for last expenditures, such as funeral expenses. Wish to match inheritances. If you plan to leave a business or residential or commercial property to one kid, whole life insurance could compensate your other children. If you need lifelong coverage but desire more investing options in your life insurance coverage than entire life provides, consider http://www.williamsonherald.com/communities/franklin-based-wesley-financial-group-named-in-best-places-to-work/article_d3c79d80-8633-11ea-b286-5f673b2f6db6.html other kinds of irreversible life insurance.

Variable life insurance or variable universal life insurance both give you access to direct financial investment in the stock exchange (how much renters insurance do i need). Indexed universal life insurance pays interest based upon the motion of stock indexes. In addition to the financial investments they provide, all these options can likewise be cheaper than entire life if the marketplace complies.

That can result in terrific savings or to unexpected expenditures. As always, discussing your individual needs with a fee-only financial organizer is a great primary step.

Term life is typically more economical than a permanent whole life policy but unlike permanent life insurance coverage, term policies have no money worth, no payout after the term ends, and no worth aside from a death benefit. To keep things simple, most term policies are "level premium" your month-to-month premium stays the very same for the entire term of the policy.

That advantage is typically tax-free (unless the premiums are paid with pre-tax dollars). You might have seen or heard advertisements that state things like, "A male non-smoker in his 30s can get a 20-year $500,000 term policy for under $30 a month." Some people can get that much protection for under $30 but it's not automated.

7 Simple Techniques For What Health Insurance Should I Get

This is called the "underwriting" procedure. They'll normally request a medical examination to assess your health, and want to know more about your profession, lifestyle, and other things. Particular pastimes like scuba diving are considered dangerous to your health, and that might raise rates. Also, harmful occupational environments for example, an oil well likewise may raise your rates.

The longer your term, the more you'll usually pay each month for a provided coverage quantity. Nonetheless, it usually pays to err on side of getting a longer-term policy than a much shorter one due to the fact that you just never know what the future holds and it is usually easier to get insurance coverage while you are more youthful and in great health.

Whatever coverage amount you require, it will likely cost less than you believed: A current survey found that 44 percent of millennials think that life insurance coverage is at https://www.ispot.tv/brands/tZk/wesley-financial-group least 5 times more pricey than the actual cost. 1 Who gets the advantage when you die? It doesn't all have to go to a single person. what does term life insurance mean.

And while recipients are normally household, they do not need to be. You could pick to leave some or all of your advantages to a trust, a charitable organization, or even a friend. As you search and begin talking to business or insurance agents you might hear about different sort of term policies.

Likewise called level term; this is the easiest, most common type of policy: Your premium stays the same for the entire term.: Also called a yearly renewable term. This policy covers you for a year at a time, with a choice to restore without a medical examination for the duration of the term however at a greater cost each year. how much do dentures cost without insurance.

This type of term policy in fact repays all or a part of your premiums if you live to the end of the term. What's the catch? Your premiums could be 2-4 times higher than with a level term policy. Likewise, if your financial status modifications and you let the policy lapse you might only get a portion of your premiums returned or absolutely nothing at all.

This also means that the insurer needs to presume that you are a dangerous prospect who has health problems, so your premiums may be much greater than they otherwise would be. Also, the policy might not pay a full death benefit for the very first few years of protection. If you have health issues but have the ability to manage them, it will typically deserve your while to get a conventional term life policy that is underwritten (i.

What Is Policy Number On Insurance Card Can Be Fun For Anyone

Convertibility is a policy arrangement that lets you alter your term insurance into a irreversible whole life policy later on without having to get a brand-new medical examination. It's a function provided by nearly all major insurer that let you alter your kind of life insurance. Guardian, for example, lets you transform level term insurance protection at any point in the first five years to a long-term life policy and even uses an optional Extended Conversion Rider which lets you do so throughout of the policy.

Another factor: you're drawn in to the money value element of an entire life policy. Or maybe you want permanent life-long protection. A term policy might well be your best choice now, however things can change. Try to find an insurance company that provides the alternative to transform from term to a whole life policy without taking another medical examination, which would likely increase your cost.

Generally, lower than whole life Normally, 6x 10x more expensive than term for the very same death advantage; but as money worth develops it can be used to supplement premiums. Renewal boost with age Cost stays the exact same for life No Yes Generally, 10 thirty years Life time coverage (as long as payments are made) Can be level or increase over the length of the policy Level stays the same monthly In many cases Most of the times No Yes cost can be offset as money value constructs (generally after 12+ years) No Yes accumulates in time 3 No Yes withdrawals and loans are enabled (but if unrepaid, this will lessen the policy worths and survivor benefit) Yes Yes Relatively basic More intricate If you have a young family, it will take several years of earnings to pay to feed, home, clothe, and educate your kids through to adulthood.

Here are a couple of basic guidelines people utilize to assist figure out how much they need:: This is one of the easiest guidelines to follow, and it can offer a helpful cushion for your family but it doesn't take all your actual expenditures and needs into account. If you include $100,000 - $150,000 for each kid, that can help ensure they can accomplish more of the chances you desire for them.

Getting The How Much Do Prescription Drugs Cost Without Insurance? To Work

Think you might desire long-term life insurance however can't manage it. Most term life policies are convertible to irreversible protection. The deadline for conversion differs by policy. Think you can invest your cash much better. Buying a less expensive term life policy lets you invest what you would have spent for a whole life policy.

In 2020, estates worth more than $11. 58 million per person or $23. 16 million per couple undergo federal estate taxes. State inheritance and estate taxes vary. Have a lifelong reliant, such as a kid with special http://www.williamsonherald.com/communities/franklin-based-wesley-financial-group-named-in-best-places-to-work/article_d3c79d80-8633-11ea-b286-5f673b2f6db6.html requirements. Life insurance can fund an unique needs trust to provide care for your kid after you're gone.

Wish to spend your retirement cost savings and still leave an inheritance or cash for final expenditures, such as funeral expenses. Desire to equalize inheritances. If you prepare to leave an organization or property to one kid, entire life insurance could compensate your other children. If you require lifelong coverage but desire more investing alternatives in your life insurance coverage than entire life provides, think about other types of permanent life insurance.

Variable life insurance coverage or variable universal life insurance coverage both provide you access to direct investment in the stock market (how much does homeowners insurance cost). Indexed universal life insurance coverage pays interest based upon the motion of stock indexes. In addition to the financial investments they offer, all these options can likewise be less expensive than entire life if the market cooperates.

That can lead to terrific cost savings or to unanticipated costs. As constantly, discussing your specific requirements with a fee-only monetary organizer is an excellent primary step.

Term life is usually more economical than a long-term whole life policy however unlike long-term life insurance coverage, term policies have no money worth, no payment after the term ends, and no value other than a survivor benefit. To keep things simple, most term policies are "level premium" your monthly premium stays the exact same for the entire term of the policy.

That advantage is normally tax-free (unless the premiums are paid with pre-tax dollars). You may have seen or heard advertisements that state things like, "A male non-smoker in his 30s can get a 20-year $500,000 term policy for under $30 a month." Some people can get that much coverage for under $30 however it's not automated.

9 Easy Facts About How To Get Insurance To Pay For Water Damage Shown

This is called the "underwriting" procedure. They'll normally ask for a medical examination to evaluate your health, and wish to know more about your occupation, way of life, and other things. Specific hobbies like scuba diving are considered dangerous to your health, and that might raise rates. Also, unsafe occupational environments for example, an oil rig likewise may raise your rates.

The longer your term, the more you'll generally pay monthly for a provided protection quantity. However, it normally pays to err on side of getting a longer-term policy than a much shorter one due to the fact that you just never ever understand what the future holds and it is usually easier to get insurance coverage while you are younger and in excellent health.

Whatever coverage amount you require, it will likely cost less than you thought: A recent survey discovered that 44 percent of millennials believe that life insurance coverage is at least 5 times more expensive than the actual cost. 1 Who gets the advantage when you die? It doesn't all need to go to someone. how to become an insurance broker.

And while beneficiaries are typically family, they do not have to be. You might choose to leave some or all of your advantages to a trust, a charitable organization, and even a good friend. As you shop around and start talking with companies or insurance agents you may find out about various type of term policies.

Likewise called level term; this is the most basic, most typical type of policy: Your premium remains the exact same for the entire term.: Also called an annual eco-friendly term. This policy covers you for a year at a time, with a choice to renew without a medical examination throughout of the term however at a greater expense each year. what is gap insurance and what does it cover.

This type of term policy in fact pays back all or a part of your premiums if you live to the end of the term. What's the catch? Your premiums might be 2-4 times greater than with a level term policy. Likewise, if your financial status changes and you let the policy lapse you might only get a portion of your premiums returned or nothing at all.

This likewise means that the insurer needs to presume that you are a risky possibility who has health problems, so your premiums might be much greater than they otherwise would be. Also, the policy may not pay a complete death benefit for the very first few years of protection. If you have health problems but have the ability to handle them, it will normally deserve your while to get a standard term life policy that is underwritten (i.

Unknown Facts About How Much Does Gap Insurance Cost

Convertibility is a policy arrangement that lets you alter your term insurance coverage into a irreversible entire life policy later without having to get a new medical examination. It's a function provided by almost all significant insurance provider that let you alter your type of life insurance coverage. Guardian, for example, lets you convert level term insurance coverage at any point in the very first 5 years to a permanent life policy and even provides an optional Extended Conversion Rider which lets you do so throughout of the policy.

Another reason: you're brought in to the cash value component of a whole life policy. Or possibly you want permanent life-long protection. A term policy might well be your finest option now, however things can change. Try to find an insurance company that offers the option to convert from term to an entire life policy without taking another medical examination, which would likely increase your cost.

Generally, lower than entire life Typically, 6x 10x more costly than term for the same death advantage; however as cash value builds it can be utilized to supplement premiums. Renewal cost increases with age Expense remains the very same for life No Yes Generally, 10 30 years Life time coverage (as long as payments are made) Can be level or boost over the length of the policy Level stays the exact same on a monthly basis In many cases For the most part No Yes expense can be balanced out as cash worth constructs (usually after 12+ years) No Yes collects in time 3 No Yes withdrawals and loans are allowed https://web.nashvillechamber.com/Real-Estate-Agents-and-Brokers/Wesley-Financial-Group,-LLC-21149?utm_source=GoogleSearch&gclid=Cj0KCQjw3s_4BRDPARIsAJsyoLMcbna5tFxdH9g--Y2UQliNiFGTrCXy6AAE6S9tZYYYuTspQQTsWakaAptfEALw_wcB (however if unrepaid, this will decrease the policy values and death benefit) Yes Yes Fairly simple More complicated If you have a young household, it will take lots of years of income to pay to feed, home, dress, and educate your children through to the adult years.

Here are a couple of basic rules people use to help determine just how much they require:: This is one of the most basic rules to follow, and it can provide a beneficial https://www.ispot.tv/brands/tZk/wesley-financial-group cushion for your household however it does not take all your real expenditures and requires into account. If you include $100,000 - $150,000 for each child, that can assist ensure they can accomplish more of the chances you want for them.

How Much Does An Mri Cost Without Insurance Can Be Fun For Anyone

Believe you might desire permanent life insurance coverage but can't afford it. The majority of term life policies are convertible to permanent coverage. The deadline for conversion differs by policy. Believe you can invest your cash better. Buying a cheaper term life policy lets you invest what you would have spent for an entire life policy.

In 2020, estates worth more than $11. 58 million per person or $23. 16 million per couple undergo federal estate taxes. State inheritance and estate taxes vary. Have a long-lasting reliant, such as a child with unique requirements. Life insurance can fund an unique needs trust to provide look after your kid after you're gone.

Desire to spend your retirement cost savings and still leave an inheritance or cash for final costs, such as funeral costs. Wish to equalize inheritances. If you plan to leave an organization or home to one child, whole life insurance could compensate your other kids. If you require lifelong coverage but want more investing alternatives in your life insurance than whole life supplies, think about other types of long-term life insurance coverage.

Variable life insurance coverage or variable universal life insurance coverage both provide you access to direct financial investment in the stock market (what is a health insurance premium). Indexed universal life insurance coverage pays interest based upon the movement of stock indexes. In addition to the financial investments they use, all these choices can likewise be less expensive than whole life if the marketplace cooperates.

That can lead to terrific savings or to unexpected expenses. As constantly, discussing your private needs with a fee-only financial organizer is a terrific primary step.

Term life is usually more economical than a long-term whole life policy but unlike permanent life insurance coverage, term policies have no money worth, no payout after the term expires, and no value besides a death advantage. To keep things easy, many term policies are "level premium" your regular monthly premium remains the exact same for the whole term of the policy.

That benefit is generally tax-free (unless the premiums are paid with pre-tax dollars). You may have seen or heard ads that state things like, "A male non-smoker in his 30s can get a 20-year $500,000 term policy for under $30 a month." Some people can get that much https://www.ispot.tv/brands/tZk/wesley-financial-group coverage for under $30 but it's not automated.

Some Ideas on When Does Car Insurance Go Down You Need To Know

This is called the "underwriting" process. They'll generally request a medical examination to examine your health, and wish to know more about your profession, lifestyle, and other things. Certain hobbies like scuba diving are considered risky to your health, and that may raise rates. Similarly, harmful occupational environments for instance, an oil well also may raise your rates.

The longer your term, the more you'll usually pay monthly for a given coverage quantity. Nonetheless, it generally pays to err on side of getting a longer-term policy than a much shorter one due to the fact that you just never understand what the future holds and it is normally easier to get insurance while you are younger and in good health.

Whatever coverage amount you need, it will likely cost less than you thought: A current survey found that 44 percent of millennials think that life insurance coverage is at least 5 times more expensive than the real expense. 1 Who gets the advantage when you die? It does not all have to go to one person. how much does pet insurance cost.

And while beneficiaries are generally household, they don't need to be. You could pick to leave some or all of your advantages to a trust, a charitable company, or perhaps a friend. As you look around and start speaking to companies or insurance agents you might find out about various type of term policies.

Likewise called level term; this is the easiest, most typical kind of policy: Your premium stays the exact http://www.williamsonherald.com/communities/franklin-based-wesley-financial-group-named-in-best-places-to-work/article_d3c79d80-8633-11ea-b286-5f673b2f6db6.html same for the entire term.: Also called an annual renewable term. This policy covers you for a year at a time, with an option to restore without a medical examination for the duration of the term but at a higher cost each year. who has the cheapest car insurance.

This kind of term policy actually repays all or a part of your premiums if you live to the end of the term. What's the catch? Your premiums could be 2-4 times greater than with a level term policy. Also, if your monetary status modifications and you let the policy lapse you may only get a part of your premiums returned or absolutely nothing at all.

This also indicates that the insurer has to assume that you are a dangerous possibility who has health problems, so your premiums may be much higher than they otherwise would be. Likewise, the policy may not pay a complete survivor benefit for the very first couple of years of coverage. If you have health issues however are able to handle them, it will generally deserve your while to get a traditional term life policy that is underwritten (i.

Fascination About I Need Surgery And Have No Insurance Where Can I Get Help

Convertibility is a policy provision that lets you alter your term insurance coverage into a irreversible entire life policy later without needing to get a brand-new medical examination. It's a function provided by practically all significant insurance business that let you change your type of life insurance. Guardian, for example, lets you convert level term https://web.nashvillechamber.com/Real-Estate-Agents-and-Brokers/Wesley-Financial-Group,-LLC-21149?utm_source=GoogleSearch&gclid=Cj0KCQjw3s_4BRDPARIsAJsyoLMcbna5tFxdH9g--Y2UQliNiFGTrCXy6AAE6S9tZYYYuTspQQTsWakaAptfEALw_wcB insurance protection at any point in the very first 5 years to a permanent life policy and even provides an optional Extended Conversion Rider which lets you do so for the duration of the policy.

Another factor: you're attracted to the cash worth component of an entire life policy. Or possibly you want long-term life-long coverage. A term policy might well be your best option now, however things can alter. Search for an insurance company that provides the alternative to transform from term to an entire life policy without taking another medical examination, which would likely increase your expense.

Typically, lower than whole life Typically, 6x 10x more pricey than term for the same death advantage; but as money value develops it can be utilized to supplement premiums. Renewal expense boosts with age Expense stays the very same for life No Yes Normally, 10 thirty years Life time coverage (as long as payments are made) Can be level or boost over the length of the policy Level remains the very same on a monthly basis In most cases For the most part No Yes expense can be balanced out as cash value constructs (typically after 12+ years) No Yes builds up with time 3 No Yes withdrawals and loans are permitted (however if unrepaid, this will diminish the policy worths and survivor benefit) Yes Yes Relatively simple More complex If you have a young household, it will take many years of earnings to pay to feed, home, dress, and inform your children through to the adult years.

Here are a couple of general rules people utilize to help identify just how much they need:: This is among the easiest rules to follow, and it can provide an useful cushion for your family but it doesn't take all your actual expenditures and requires into account. If you add $100,000 - $150,000 for each kid, that can assist guarantee they can attain more of the opportunities you want for them.

Fascination About What Is A Certificate Of Insurance

Think you might desire permanent life insurance coverage however can't afford it. Most term life policies are convertible to permanent protection. The deadline for conversion varies by policy. Think you can invest your cash better. Purchasing a https://www.ispot.tv/brands/tZk/wesley-financial-group more affordable term life policy lets you invest what you would have spent for a whole life policy.

In 2020, estates worth more than $11. 58 million per person or $23. 16 million per couple go through federal estate taxes. State inheritance and estate taxes vary. Have a long-lasting dependent, such as a kid with unique needs. Life insurance can fund a special requirements trust to provide take care of your child after you're gone.

Wish to invest your retirement savings and still leave an inheritance or money for last costs, such as funeral expenses. Wish to match inheritances. If you plan to leave a service or residential or commercial property to one child, entire life insurance coverage could compensate your other kids. If you require long-lasting protection but want more investing options in your life insurance coverage than entire life supplies, consider other kinds of long-term life insurance.

Variable life insurance coverage or variable universal life insurance coverage both offer you access to direct financial investment in the stock market (who is eligible for usaa insurance). Indexed universal life insurance coverage pays interest based on the motion of stock indexes. In addition to the investments they provide, all these alternatives can likewise be less expensive than entire life if the marketplace complies.

That can lead to fantastic cost savings or to unforeseen costs. As always, discussing your private requirements with a fee-only financial organizer is a terrific initial step.

Term life is usually more economical than a long-term entire life policy however unlike long-term life insurance coverage, term policies have no cash value, no payment after the term expires, and no value other than a death benefit. To keep things basic, most term policies are "level premium" your monthly premium stays the very same for the entire regard to the policy.

That advantage is typically tax-free (unless the premiums are paid with pre-tax dollars). You might have seen or heard ads that say things like, "A male non-smoker in his 30s can get a 20-year $500,000 term policy for under $30 a month." Some individuals can get that much protection for under $30 but it's not automatic.

The Basic Principles Of How Much Will My Insurance Go Up After An Accident

This is called the "underwriting" process. They'll normally ask for a medical exam to examine your health, and would like to know more about your occupation, lifestyle, and other things. Particular hobbies like scuba diving are deemed dangerous to your health, and that may raise rates. Similarly, harmful occupational environments for example, an oil rig also may raise your rates.

The longer your term, the more you'll usually pay every month for an offered coverage quantity. However, it normally pays to err on side of getting a longer-term policy than a shorter one due to the fact that you simply never ever understand what the future holds and it is normally simpler to get insurance coverage while http://www.williamsonherald.com/communities/franklin-based-wesley-financial-group-named-in-best-places-to-work/article_d3c79d80-8633-11ea-b286-5f673b2f6db6.html you are younger and in good health.

Whatever protection amount you need, it will likely cost less than you thought: A current survey discovered that 44 percent of millennials think that life insurance is at least five times more expensive than the real expense. 1 Who gets the advantage when you pass away? It does not all need to go to a single person. how much is adderall without insurance.

And while recipients are typically household, they do not have to be. You could pick to leave some or all of your advantages to a trust, a charitable organization, and even a pal. As you search and start talking with companies or insurance coverage representatives you might find out about different type of term policies.

Also called level term; this is the easiest, most common type of policy: Your premium stays the very same for the whole term.: Also called a yearly renewable term. This policy covers you for a year at a time, with an option to renew without a medical examination for the duration of the term but at a greater expense each year. how to become an insurance broker.

This type of term policy actually repays all or a portion of your premiums if you live to the end of the term. What's the catch? Your premiums could be 2-4 times higher than with a level term policy. Also, if your monetary status modifications and you let the policy lapse you might just get a portion of your premiums returned or absolutely nothing at all.

This also suggests that the insurer needs to presume that you are a risky prospect who has health concerns, so your premiums may be much greater than they otherwise would be. Likewise, the policy may not pay a full death advantage for the very first few years of coverage. If you have health issues but are able to handle them, it will generally deserve your while to get a standard term life policy that is underwritten (i.

Some Known Factual Statements About What Does Term Life Insurance Mean

Convertibility is a policy provision that lets you alter your term insurance coverage into a permanent entire life policy later on without having to get a brand-new medical examination. It's a function used by practically all significant insurance provider that let you alter your kind of life insurance coverage. Guardian, for example, lets you convert level term insurance protection at any point in the very first 5 years to a long-term life policy and even uses an optional Extended Conversion Rider which lets you do so for the period of the policy.

Another reason: you're attracted to the cash worth component of a whole life policy. Or perhaps you want irreversible life-long protection. A term policy may well be your finest option now, however things can change. Look for an insurer that uses the choice to transform from term to a whole life policy without taking another medical examination, which would likely increase your cost.

Generally, lower than whole life Generally, 6x 10x more pricey than term for the exact same death benefit; but as money worth builds it can be used to supplement premiums. Renewal boost with age Cost remains the same for life No Yes Normally, 10 thirty years Lifetime coverage (as long as payments are made) Can be level or https://web.nashvillechamber.com/Real-Estate-Agents-and-Brokers/Wesley-Financial-Group,-LLC-21149?utm_source=GoogleSearch&gclid=Cj0KCQjw3s_4BRDPARIsAJsyoLMcbna5tFxdH9g--Y2UQliNiFGTrCXy6AAE6S9tZYYYuTspQQTsWakaAptfEALw_wcB increase over the length of the policy Level stays the exact same every month In most cases For the most part No Yes cost can be balanced out as cash worth builds (normally after 12+ years) No Yes accumulates in time 3 No Yes withdrawals and loans are enabled (however if unrepaid, this will reduce the policy worths and survivor benefit) Yes Yes Relatively simple More intricate If you have a young household, it will take many years of income to pay to feed, home, dress, and inform your children through to the adult years.

Here are a couple of basic rules people utilize to help determine just how much they require:: This is one of the simplest guidelines to follow, and it can offer a beneficial cushion for your family but it does not take all your actual expenses and requires into account. If you add $100,000 - $150,000 for each child, that can assist ensure they can accomplish more of the chances you want for them.

Where Can I Go For Medical Care Without Insurance Can Be Fun For Anyone

Health profile and level term lengthAge 30Age 40Age 50Age 60Female non-smoker 10-year term$ 223$ 306$ 573$ 1,184 Female non-smoker 20-year term$ 314$ 477$ 955$ 2,310 Female non-smoker 30-year term$ 431$ 695$ 1,537$ 7,300 * Female cigarette smoker 10-year term$ 439$ 692$ 1,482$ 3,072 Female smoker 20-year term$ 669$ 1,185$ 2,386$ 5,219 Female cigarette smoker 30-year term$ 915$ 1,655$ 3,695$ 13,030 * Male non-smoker 10-year term$ 263$ 358$ 735$ 1,716 Male non-smoker 20-year term$ 368$ 565$ 1,226$ 3,128 Male non-smoker 30-year term$ 528$ 872$ 2,023$ 7,300 * Male cigarette smoker 10-year term$ 553$ 866$ 1,970$ 4,424 Male cigarette smoker 20-year term$ 826$ 1,487$ 3,177$ 7,100 Male cigarette smoker 30-year term$ 1,166$ 2,140$ 4,470$ 13,030 ** Limited quotes offered. Information source: Compulife Quote System since August 2020.

You might not have the ability to stop aging, however you can absolutely stop smoking. After 5 years, you can likely certify for non-smoker rates. You don't have to be a cigarette smoker to get cigarette smoking rates. Anything that provides nicotine into your system, from nicotine spots to e-cigarettes, will garner you greater life insurance rates.

Ellis recommends that it's a great concept to get life insurance coverage as quickly as another person depends upon your earnings. "This could be when you and somebody else sign a lease together or purchase a car/home. Or it could be whenever you have children. If one spouse is 'remain at house,' I would still suggest they acquire some life insurance.

When your dependents are economically steady, you must drop your life insurance other than for perhaps a little amount to spend for a funeral," Ellis includes. Expenses can increase quickly when you look after a family, pay a home loan, strategy for college and all of the other factors involved in your financial resources.

Getting My How Much Is Long Term Care Insurance To Work

com. "It's a time in life when you have a substantial quantity of living costs and debt. Raising your term amount when you are young and healthy is economical and an excellent concept, considering that the rates will increase substantially as you age." When you look for term life coverage, you'll be asked questions about your personal health history and family health insurance coverage.

Don't be surprised if you're asked the very same set of concerns more than when first by your representative and then by the paramedical professional who conducts the test. Some brand-new insurance providers are offering instant-approval policies where a medical examination is not required but still use high policy limits. Also, some widely known life insurance coverage companies are providing same-day approval policies.

Selecting the best term life policy needs a little investment of time, but the advantages can be valuable. The first reason for this is obvious: The ideal policy will help take care of your recipients in case you pass away. But the second factor, which will benefit you even if you outlast your life insurance coverage policy, is the comfort that includes knowing that you and your loved ones are covered.

Utilize the life insurance calculator to discover just how much protection you must have. A life insurance calculator takes into account your funeral costs, home loan, income, debt, education to offer you a clear estimate of the ideal amount of life insurance coverage. 2. Picking a life insurance company. Guarantee. com keeps a list of the best life insurance companies based on client evaluations, making selecting a credible insurance company simpler.

How Does Whole Life Insurance Work for Dummies

Choosing the length of the policy. Common terms consist of five, 10, 15, 20 and 30 years. 4. Choosing the amount of the policy. This is the sum your beneficiaries will get in case of your death. The quantity you select should depend on a number of factors, including your income, debts and the variety of individuals who depend upon you economically.

5. Medical checkup. The exam generally covers your height, weight, high blood pressure, medical history and blood and urine screening. 6. Initiation of policy. When your policy is in place, keeping it refers paying your regular monthly premiums. From there, if you pass away while the policy is in force, your recipients receive the face quantity of the policy tax-free.

Term life insurance, likewise known as pure life insurance coverage, is a kind of life insurance that guarantees payment of a specified death benefit if the covered individual passes away during a specified term. Once the term ends, the insurance policy holder can either restore it for another term, transform the policy to irreversible coverage, or permit the policy to end.

These policies have no value besides the guaranteed Click here! death advantage and function no savings element as found in a whole life insurance product. Term life premiums are based upon a person's age, health, and life span. When you buy a term life insurance policy, the insurer figures out the premiums based on the value of the policy (the payout quantity) in addition to your age, gender, and health.

Indicators on How Much Does An Mri Cost http://cashwlij734.yousher.com/about-how-do-life-insurance-companies-make-money With Insurance You Should Know

The insurer may also inquire about your driving record, current medications, smoking cigarettes status, profession, hobbies, and household history. If you die during the term of the policy, the insurer will pay the stated value of the policy to your beneficiaries. This money benefitwhich is, for the most part, not taxablemay be used by beneficiaries to settle your health care and funeral service costs, customer financial obligation, or home mortgage debt among other things.

You may be able to renew a term policy at its expiration, but the premiums will be recalculated for your age at the time of renewal. Term life policies have no worth besides the ensured death advantage - how long can children stay on parents insurance. There is no savings part as found in a whole life insurance coverage product.

A healthy 35-year-old non-smoker can typically acquire a 20-year level-premium policy with a $250,000 stated value for $20 to $30 per month. Acquiring an entire life equivalent would have substantially higher premiums, perhaps $200 to $300 per month. Since many term life insurance policies end before paying a death benefit, the overall threat to the insurance company is lower than that of a permanent life policy.

When you consider the quantity of protection you can get for your premium dollars, term life insurance tends to be the least pricey alternative for life insurance. Rate of interest, the financials of the insurer, and state policies can likewise affect premiums. In basic, business typically offer much better rates at "breakpoint" coverage levels of $100,000, $250,000, $500,000, and $1,000,000.

Not known Incorrect Statements About How Much Is Flood Insurance In Florida

He buys a $500,000 10-year term life insurance coverage policy with a premium of $50 monthly. If George dies within the 10-year term, the policy will pay George's beneficiary $500,000. If he passes away after he turns 40, when the policy has ended, his recipient will get no benefit. If he restores the policy, the premiums will be greater than with his preliminary policy due to the fact that they will be based on his age of 40 rather of 30.

Some policies do use ensured re-insurability (without proof of insurability), Learn more but such features, when offered, tend to make the policy cost more. There are a number of different types of term life insurance; the very best alternative will depend upon your individual circumstances. These provide protection for a specified period varying from 10 to thirty years.

Due to the fact that actuaries must represent the increasing expenses of insurance coverage over the life of the policy's efficiency, the premium is relatively higher than yearly renewable term life insurance coverage. Annual renewable term (YRT) policies have no given term, but can be renewed each year without providing proof of insurability. The premiums alter from year to year; as the guaranteed person ages, the premiums increase.

A Biased View of How To Get Therapy Without Insurance

Health profile and level term lengthAge 30Age 40Age 50Age 60Female non-smoker 10-year term$ 223$ 306$ 573$ 1,184 Female non-smoker 20-year term$ 314$ 477$ 955$ 2,310 Female non-smoker 30-year term$ 431$ 695$ 1,537$ 7,300 * Female cigarette smoker 10-year term$ 439$ 692$ 1,482$ 3,072 Female smoker 20-year term$ 669$ 1,185$ 2,386$ 5,219 Female cigarette smoker 30-year term$ 915$ 1,655$ 3,695$ 13,030 * Male non-smoker 10-year term$ 263$ 358$ 735$ 1,716 Male non-smoker 20-year term$ 368$ 565$ 1,226$ 3,128 Male non-smoker 30-year term$ 528$ 872$ 2,023$ 7,300 * Male smoker 10-year term$ 553$ 866$ 1,970$ 4,424 Male cigarette smoker 20-year term$ 826$ 1,487$ 3,177$ 7,100 Male cigarette smoker 30-year term$ 1,166$ 2,140$ 4,470$ 13,030 ** Limited quotes available. Data source: Compulife Quote System since August 2020.

You might not have Click here! the ability to stop aging, but you can definitely stop cigarette smoking. After 5 years, you can likely receive non-smoker rates. You don't need to be a smoker to get cigarette smoking rates. Anything that provides nicotine into your system, from nicotine patches to e-cigarettes, will garner you greater life insurance coverage rates.

Ellis advises that it's a great concept to get life insurance as quickly as another person depends upon your earnings. "This might be when you and another person sign a lease together or purchase a car/home. Or it might be whenever you have kids. If one partner is 'remain at home,' I would still suggest they acquire some life insurance.

Once your dependents are solvent, you must drop your life insurance other than for maybe a percentage to pay for a funeral," Ellis includes. Costs can increase quick when you take care of a household, pay a home mortgage, plan for college and all of http://cashwlij734.yousher.com/about-how-do-life-insurance-companies-make-money the other elements included in your finances.

Indicators on How Much Is Urgent Care Without Insurance You Should Know

com. "It's a time in life when you have a considerable quantity of living expenses and financial obligation. Raising your term amount when you are young and healthy is inexpensive and a good concept, given that the rates will increase substantially as you age." When you get term life coverage, you'll be asked concerns about your personal health history and household health insurance coverage.

Don't be surprised if you're asked the very same set of questions more than as soon as first by your representative and after that by the paramedical specialist who performs the exam. Some new insurance providers are providing instant-approval policies where a medical examination is not needed but still use high policy limits. Also, some popular life insurance companies are using same-day approval policies.

Selecting the ideal term life policy needs a little investment of time, but the benefits can be valuable. The first reason for this is apparent: The ideal policy will help look after your beneficiaries in case you pass away. But the second reason, which will benefit you even if you outlast your life insurance coverage policy, is the assurance that comes with understanding that you and your liked ones are covered.

Use the life insurance calculator to find how much protection you ought to have. A life insurance calculator takes into account your funeral expenses, mortgage, income, debt, education to provide you a clear quote of the ideal quantity of life insurance coverage. 2. Selecting a life insurance company. Guarantee. com preserves a list of the finest life insurance coverage business based upon consumer reviews, making choosing a credible insurance provider much easier.

Everything about How Much Do Prescription Drugs Cost Without Insurance?

Picking the length of the policy. Common terms consist of 5, 10, 15, 20 and thirty years. 4. Picking the quantity of the policy. This is the amount your beneficiaries will receive in the occasion of your death. The quantity you choose should depend upon a number of elements, including your earnings, financial obligations and the variety of individuals who depend upon you financially.

5. Medical exam. The exam typically covers your height, weight, high blood pressure, medical history and blood and urine screening. 6. Initiation of policy. When your policy is in location, maintaining it refers paying your monthly premiums. From there, if you pass away while the policy is in force, your beneficiaries get the face amount of the policy tax-free.

Term life insurance coverage, likewise referred to as pure life insurance coverage, is a kind of life insurance that guarantees payment of a mentioned survivor benefit if the covered individual passes away during a specified term. When the term ends, the policyholder can either renew it for another term, transform the policy to long-term coverage, or allow the policy to end.

These policies have no value other than the ensured survivor benefit and function no savings component as discovered in a whole life insurance coverage item. Term life premiums are based upon a person's age, health, and life expectancy. When you purchase a term life insurance coverage policy, the insurance coverage company identifies the premiums based upon the worth of the policy (the payment quantity) as well as your age, gender, and health.

How Much Does An Insurance Agent Make for Dummies

The insurance coverage business might also inquire about your driving record, existing medications, smoking cigarettes status, occupation, pastimes, and family history. If you pass away throughout the regard to the policy, the insurance company will pay the face value of the policy to your beneficiaries. This money benefitwhich is, in most cases, not taxablemay be utilized by beneficiaries to settle your healthcare and funeral service costs, consumer financial obligation, or home loan financial obligation to name a few things.

You may be able to restore a term policy at its expiration, but the premiums will be recalculated for your age at the time of renewal. Term life policies have no value aside from the ensured death advantage - what is a premium in insurance. There is no cost savings component as found in a whole life insurance coverage item.

A healthy 35-year-old non-smoker can generally get a 20-year level-premium policy with a $250,000 stated value for $20 to $30 per month. Acquiring a whole life equivalent would have substantially greater premiums, perhaps $200 to $300 each month. Because most term life insurance policies end before paying a death advantage, the general risk to the insurance company is lower than that of a permanent life policy.

When Learn more you think about the quantity of coverage you can get for your premium dollars, term life insurance coverage tends to be the least pricey option for life insurance coverage. Rates of interest, the financials of the insurance coverage business, and state guidelines can also impact premiums. In general, business frequently use much better rates at "breakpoint" coverage levels of $100,000, $250,000, $500,000, and $1,000,000.

Some Known Details About How Do Life Insurance Companies Make Money

He buys a $500,000 10-year term life insurance coverage policy with a premium of $50 per month. If George dies within the 10-year term, the policy will pay George's beneficiary $500,000. If he dies after he turns 40, when the policy has actually expired, his recipient will receive no benefit. If he restores the policy, the premiums will be greater than with his initial policy due to the fact that they will be based upon his age of 40 instead of 30.

Some policies do provide guaranteed re-insurability (without proof of insurability), however such functions, when offered, tend to make the policy cost more. There are a number of different types of term life insurance; the very best option will depend upon your private circumstances. These provide coverage for a specific period varying from 10 to thirty years.

Due to the fact that actuaries should account for the increasing expenses of insurance over the life of the policy's effectiveness, the premium is relatively greater than yearly eco-friendly term life insurance coverage. Annual eco-friendly term (YRT) policies have no specified term, but can be renewed each year without supplying evidence of insurability. The premiums alter from year to year; as the insured person ages, the premiums increase.

What Does How Do Life Insurance Companies Make Money Do?

More junior representatives can typically advance in making possible and obligation if they prefer to do so, as they acquire more experience in the industry. However the crucial thing to keep in mind about being a life insurance representative is this: When you're a life insurance coverage representative, you're not simply offering an item. In later years, the representative might get anywhere from 3-10% of each year's premium, also understood as "renewals" or "tracking commissions." Let's take a look at an example: Bob the insurance agent offers Sally a whole life insurance coverage policy that covers her for the rest of her life as long as she continues to make her premium payments.

The policy costs Sally $100 each month or $1,200 each year. Therefore, in the very first year, Bob will make a $1,080 commission on selling this life insurance coverage policy ($ 1,200 x 90%). In all subsequent years, Bob will make $60 in renewals as long as Sally continues to pay the premiums ($ 1,200 x 5%).

As discussed before, a life insurance agent is not an occupation for the thin-skinned or faint of heart. In reality, more than any other factor, consisting of education and experience, life insurance agents need to have a battling spirit. They need to be people who love the thrill of the hunt, the rush of a sale, and see rejection as a stepping stone to ultimate success.

The large majority of life insurance coverage companies have no official education requirements for becoming a representative. While lots of choose college graduates, this general guideline is constantly overlooked in favor of the "best" candidates. Previous experience in the insurance industry is not required since a lot of medium and large insurance providers have internal programs to train their salespeople about the items they're going to sell.

Insurance representatives are presently licensed by the private state or states in which they'll be offering insurance coverage. This normally needs passing a state-administered licensing exam as well as taking a licensing class that generally runs 25-50 hours. The sales commission life insurance representatives might make in the first year if they are on a commission-only wage; that's the greatest commission for any kind of insurance.

First and primary, you'll require to create a resume that highlights your entrepreneurial spirit. how much does a state farm insurance agent make. You'll wish to include anything that reveals you taking initiative to make things occur, whether it was beginning your own service or taking somebody else's company to the next level. Life insurance coverage agents need to be driven and have the ability to be self-starters.

The Basic Principles Of How To Find An Insurance Agent

When you've got your resume polished, you'll desire to begin finding positions and using. It's truly important you don't feel forced to take the very first position that occurs, as working for the incorrect business can both burn you out and haunt you for the rest of your insurance coverage profession.

Possibly the very best location to begin in choosing where to apply is to check out the insurance provider score sites for A.M. Finest, Moody's, or Requirement & Poor's. From there, you'll have the ability to construct a list of companies that have rankings of "A" or higher in your state. These business will usually offer the most-secure items at sensible rates, with a focus on compensating and keeping quality representatives.

When you have actually developed this list, begin looking at each business. Due to the high turnover rate of insurance agents, the majority of business plainly post their job listings by geographical location, that makes them easily searchable for you. Click here for more info When you find a company in your area that appears to fit your character, get the position as the business advises on its website.

Lots of insurer employers won't even interview a prospective agent who does not first make a follow-up call, because this is a strong sign of a potential agent's persistence. During your interview, continue to communicate your entrepreneurial and "never ever say give up" personality, due to the fact that most supervisors will employ someone based upon these factors over all the others integrated.

Your sales manager will be the first to remind you that your only purpose in life is to discover prospective customers. In reality, they'll be even more interested in the number of contacts you're making each week than how well you know their line of product. Do anticipate to struggle economically for the very first couple of months up until your first sales commissions begin rolling in.

Many representatives are now fortunate to be compensated for one to two months of training before being placed on a "commission-only" basis. While the life insurance industry pledges fantastic benefits for those who are ready to work hard and bear with a good amount of rejection, there are 2 other pitfalls you need to be knowledgeable about.

The Basic Principles Of Who Does An Agent Represent During The Solicitation Of Insurance?

While that may be appealing and appear like a terrific idea to get you started, it can also burn a lot of bridges with individuals you appreciate. Second, you ought to visit your state insurance coverage commissioner's site and have a look at the complaint timeshare explained history versus companies that you're thinking about working for.

Accepting a task with the wrong insurance business will go a long method towards burning you out and destroying your imagine a promising profession. If a career in life insurance sales is something you really desire, take your time and wait on the best opportunity at the right business.

Insurance coverage is too complicated. I'm not qualified. It's too late to alter careers. If you've ever considered the actions to ending up being an insurance coverage agent, you've likely been exposed to these typical misunderstandings and misunderstandings http://elliottsiuu202.jigsy.com/entries/general/facts-about-how-to-find-out-if-life-insurance-policy-exists-uncovered about selling insurance coverage. To set the record straight, Farm Bureau Financial Providers is here to bust the leading myths about ending up being an insurance agent and aid ensure nothing stands between you and your dream opportunity! The fact is, most of our representatives don't have a background in insurance sales.

Though a lot of our leading candidates have some previous experience in sales, service and/or marketing, certain characteristic, such as having an entrepreneurial spirit, self-motivation and the capability to interact successfully, can lay the right structure for success in becoming an insurance agent. From here, we equip our representatives with concentrated training, continuing education chances and individually mentorship programs created to help them learn the ins and outs of the industry.

Farm Bureau agents discover their profession path to be satisfying and rewarding as they help people and families within their neighborhood protect their incomes and futures. They understand that their business is not practically insurance products - it's about people, relationships and making entire communities healthier, more secure and more safe and secure.

Our group members are trained on our sales procedure which will assist them identify the very best protection for each client/member or organization. The Farm Bureau sales procedure begins with recognizing a prospect, whether you're selling a personal policy or a commercial policy. From there, you can be familiar with the possible client/member, find their requirements and identify their long-lasting goals.

What Does What Does An Insurance Agent Do Do?

More details on fingerprinting for Nevada resident licensing can be discovered here. what is a captive insurance agent. California needs a minimum of 20 hours of approved pre-licensing study. A brand-new resident applicant who had a present Accident and Health license in another state within the last 90 days and has a current non-resident license in California or a candidate holding a Life Underwriter Training Council Fellowship (LUTCF), Chartered Life Underwriter (CLU), Certified Insurance Coverage Counselor (CIC), Qualified Staff Member Benefit Expert (CEBS), Fellow, Life Management Institute (FLMI), Health Insurance Coverage Associate (HIA), Registered Staff Member Benefits Consultant (REBC) or Registered Health Underwriter (RHU) designation is exempt from the 20 hours of pre-licensing education.

Nevada has a similar requirement. Prospects should satisfactorily complete an authorized course of education (of 20 hours) in each field of insurance for which they prepare to be licensed. You must be at least 18 years of age and you must pass your state's homeowner or non-resident licensing examination to make a license.

In California, PSI Solutions, LLC, a California-based business supplying state-based regulatory licensure services, manages the scheduling of assessments for people. People might arrange their examinations with PSI either online or by telephone. PSI provides more than 20 sites statewide where individuals might take their qualifying license assessment and offer the needed finger prints.

More about the California application procedure can be discovered here.) In Nevada, Pearson VUE is the Insurance Department's only authorized testing vendor. Visits may be made up to one calendar day prior to the day you wish to check, based on accessibility. You can examine the Pearson VUE scheduling options for Nevada here.

On the day of the exam, you'll wish to show up 20 to 30 minutes early and bring 2 kinds of recognition (ID) that consist of a signature. Your name on the ID must precisely match the name on your registration. The main identification must be government-issued and photo-bearing ID with a signature, and the secondary identification must likewise contain a legitimate signature.

Dept. of State Motorist's License U.S. Student's Authorization (plastic card only with picture and signature) National/State/Country ID card Passport Passport Card Military ID Armed force ID for spouses and dependents Acceptable, non-expired secondary IDs (with a signature) consist of: U.S. Social Security card Debit (ATM) or charge card Any form of ID on the main ID list above After you've earned your license, you will require to protect professional liability insurance coverage, also known as Errors & Omissions (E&O) protection.

The 4-Minute Rule for How To Become An Independent Insurance Agent For Progressive

CalSurance deals inexpensive E&O to Word & Brown brokers, and it takes simply minutes to apply. Ask us for details, or go here to find out more. After you have actually earned your license, you normally require to earn Postgraduate work Credits to keep it. In California, you're required to satisfactorily complete approved courses or programs of instruction or attend workshops comparable to 24 hours of direction throughout each two-year license period, consisting of at least 3 hours of principles training, prior to your license can be renewed.

Word & Brown, our provider partners, and the state and regional health underwriter associations provide a variety of CE courses throughout the year to help you satisfy your mandated licensing renewal requirements. To get information on courses, recorded webinars, and occasions, check out the Word & Brown Newsroom. Word & Brown is devoted to assisting individuals who want to enter the exciting and progressing world of health insurance sales.

If you are interested in utilizing an online course to prepare for your license test, Word & Brown uses a 20% discount through the Mike Russ Financial Training Centers; ask us for information.

Select a license type below to apply for that license or find out how to: Update your address or name. Print your license. Get continuing education credits. Renew your license.

Few industries exterior of the financial services market use the capacity for reasonably inexperienced experts to make substantial earnings within their very first year of employment. Within the financial services industry, couple of careers offer beginners the chance to make so much right off the bat as a life insurance coverage representative. In reality, a hard-working insurance coverage agent can make more than $100,000 in their very first year of sales.

It's a tough field and many individuals stress out earlier instead of later on. Insurance representatives hear "no" much more than they hear "yes." It's not uncommon for the "no" to come mixed with a fair amount of profanities and the proverbial door in the face. In addition, many people hold insurance representatives in low regard, with some individuals relating them to glorified bilker.

Little Known Questions About Why Choose An Independent Insurance Agent.

The career of a life insurance representative is rewarding however includes constant hustling, networking, and rejection before a sale is made. Life insurance coverage agents might be offered a little salary to begin however are otherwise mostly Great site based on commissions to make a living. Finding potential consumers is tough and time-consuming; getting those clients to buy as soon as you track them down is even harder.

When looking for a job be sure that you only apply to companies that are well reviewed by ranking agencies like Moody's and Standard & Poor's. While there are many sort of insurance coverage (ranging from auto insurance coverage to health insurance), the very best money in the insurance field is for those offering life insurance.

Insurance agents selling this type of protection are either "captive" agents, which implies they only sell insurance coverage from one company, or "non-captive," suggesting they represent numerous insurance coverage providers. In any case, the common insurance coverage agent is going to spend the bulk of his/her time participating in some kind of marketing activity to identify people who might be in need of new or additional insurance protection, providing them with quotes from the business they represent and encouraging them to sign the brand-new insurance agreement.

In later years, the agent may receive anywhere from 3-10% of each year's premium, likewise referred to as "renewals" or "trailing commissions." Let's take a look at an example: Bob the insurance representative sells Sally a entire life insurance policy that covers her for the rest of her life as long as she continues to make her premium payments.

The policy costs Sally $100 each month or $1,200 annually. Therefore, in the first year, Bob will make a $1,080 commission on offering this life insurance coverage policy ($ 1,200 x 90%). In all subsequent years, Bob will make $60 in renewals as long as Sally continues to pay the premiums ($ 1,200 x 5%).

As discussed previously, https://telegra.ph/some-known-details-about-how-do-i-become-a-insurance-agent-11-03 a life insurance representative is not an occupation for the thin-skinned or faint of heart. In reality, more than any other factor, including education and experience, life insurance agents must possess a battling spirit. They should be people who enjoy the excitement of the hunt, the rush of a sale, and see rejection as a stepping stone to ultimate success.

Everything about What Does An Insurance Agent Do

The huge majority of life insurance business have no official education requirements for becoming a representative. While lots of prefer college graduates, this general guideline is continuously neglected in favor of the "ideal" candidates. Previous experience in the insurance industry is not required due to the fact that the majority of medium and big insurance providers have internal programs Look at more info to train their salesmen about the items they're going to offer.

The Ultimate Guide To How To Become A Non Captive Insurance Agent

The career of a life insurance coverage representative is rewarding but involves consistent hustling, networking, and rejection prior to a sale is made. Life insurance coverage representatives may be provided a small wage to get going but are otherwise primarily depending on commissions to earn a living. Discovering prospective clients is tough and time-consuming; getting those customers to purchase once you track them down is even harder.

When looking for a task make sure that you just use to companies that are well reviewed by score agencies like Moody's and Requirement & Poor's. While there are many kinds of insurance coverage (varying from auto insurance to medical insurance), the finest cash in the insurance field is for those selling life insurance.

Insurance agents offering this type of protection are either "captive" agents, which means they only sell insurance coverage from one business, or "non-captive," implying they represent several insurance coverage carriers. Either way, the common insurance coverage agent is going to spend the how do i cancel my wfg bulk of his/her time engaging in some kind of marketing activity to determine people who might be in requirement of new or extra insurance protection, providing them with quotes from the business they represent and persuading them to sign the new insurance coverage agreement.

In later years, the representative may receive anywhere from 3-10% of each year's premium, likewise called "renewals" or "tracking commissions." Let's look at an example: Bob the insurance coverage representative offers Sally a entire life insurance coverage policy that covers her for the rest of her life as long as she continues to make her premium payments.

The policy costs Sally $100 per month or $1,200 per year. Thus, in the very first year, Bob will make a $1,080 commission on selling this life insurance policy ($ 1,200 x 90%). In all subsequent years, Bob will make $60 in renewals as long as Sally continues to pay the premiums ($ 1,200 x 5%).

As mentioned in the past, a life insurance coverage representative is not a profession for the thin-skinned or faint of heart. In truth, more than any other aspect, including education and experience, life insurance agents need to possess a fighting spirit. They must be individuals who like the adventure of the hunt, the rush of a sale, and see rejection as a stepping stone to ultimate success.

Facts About How To Become A Cyber Insurance Agent Uncovered

The large majority of life insurance business have no official education requirements for becoming a representative. While many choose college graduates, this basic rule is constantly neglected in favor of the "right" prospects. Previous experience in the insurance market is not required due to the fact that many medium and large insurance coverage carriers have internal programs to train their salespeople about the items they're going to sell.

Insurance coverage representatives are currently accredited by the private state or states in which they'll be selling insurance coverage. This usually needs passing a state-administered licensing exam in addition to taking a licensing class that usually runs 25-50 hours. The sales commission life insurance agents may earn in the first year if they are on a commission-only income; that's the greatest commission for any type of insurance.

Most importantly, you'll need to assemble a resume that highlights your entrepreneurial spirit. You'll wish to consist of anything that reveals you taking effort to make things happen, whether it was beginning your own organization or taking somebody else's business to the next level. Life insurance coverage representatives need to be driven and have the capability to be self-starters.

When you have actually got your resume polished, you'll want to start discovering positions and applying. how to be insurance agent. It's really essential you do not feel forced to take the first position that comes along, as working for the incorrect business can both burn you out and haunt you for the rest of your insurance career.

Possibly the very best location to start in deciding where to use is to check out the insurer score websites for A.M. Best, Moody's, or Requirement & Poor's. From there, you'll have the ability to develop a list of companies that have scores of "A" or higher in your state. These companies will normally offer the most-secure products at affordable prices, with an emphasis on compensating and keeping quality agents.

When you've created this list, begin looking at each business. Due to the high turnover rate of insurance coverage agents, the majority of business prominently post their job listings by geographical area, that makes them quickly searchable for you. When you discover a company in your location that seems to fit your character, obtain the position as the company instructs on its site.

Excitement About How To Become Truck Insurance Agent

Numerous insurance provider recruiters won't even interview a prospective agent who does not first make a follow-up call, due to the fact that this is a strong indicator of a possible agent's persistence. During your interview, continue to interact your entrepreneurial and "never ever say give up" character, due to the fact that the majority of managers will hire somebody based upon these factors over all the others combined.

Your sales supervisor will be the first to remind you that your only purpose in life is to find potential clients. In reality, they'll be far more interested in the number of contacts you're making every week than how well you understand their product line. Do anticipate to struggle economically for https://www.trustpilot.com/review/timesharecancellations.com the very first couple of months until your first sales commissions begin rolling in.

Numerous representatives are now lucky to be compensated for one to two months of training before being put on a "commission-only" basis. While the life insurance industry guarantees great benefits for those who are ready to work hard and endure a good amount of rejection, there are 2 other pitfalls you require to be aware of.

While that might be tempting and appear like an excellent idea to get you began, it can also burn a great deal of bridges with people you appreciate. Second, you must visit your state insurance coverage commissioner's site and inspect out the problem history versus companies that you're considering working for.

Accepting a job with the wrong insurance business will go a long way toward burning you out and ruining your imagine an appealing profession. If a profession in life insurance coverage sales is something you truly desire, take your time and await the best opportunity at the right business.

One of the most common questions asked by students who enroll in America's Professor's online insurance coverage representative test preparation courses is a relatively obvious one: "Just how much money can I anticipate to make?" The bright side is, most insurance coverage representatives can expect to make well above the average median income.

See This Report on Who Does An Agent Represent During The Solicitation Of Insurance?

programs that the majority of them can making a comfy earnings from their work. The most current government data relating to the typical earnings of American insurance coverage agents was put together in. According to that data from the Bureau of Labor Data: The mean annual wage for insurance agents was. The greatest paid 10% of insurance agents made more than.

As the numbers reveal, there is a broad variety of possible earnings for insurance agents. Because the quantity of cash insurance agents make is consisted of largely of commissions and benefits, the variety of sales an insurance agent makes is the greatest aspect that contributes to the disparity in between the greatest and lowest paid of insurance representatives.

What Does An Insurance Agent Do On A Daily Basis Things To Know Before You Get This

Studying is not allowed in the test center. The test administrator will supply you with materials to make notes or computations. You may not compose on these products prior to the test starts or get rid of these items from the screening room. Calculators are permitted just if they are silent, hand-held, nonprinting, and without an alphabetic keypad.

You will have the chance to take a tutorial that will not lower the exam time. Each significant line examination is given up a multiple-choice format. The test includes two parts: The basic section offers with standard insurance coverage product understanding The state area offers with insurance coverage laws, rules, and policies, and practices that are distinct to Texas Each exam contains "pretest" concerns that are blended in with the scored concerns and are not determined.

When you complete the exam, you will receive a rating report marked https://www.prweb.com/releases/2012/8/prweb9766140.htm "pass or fail". Prospects who fail will receive a score report that consists of a numerical rating, diagnostic and re-testing info. Prospects can set up another exam but. InsTX-LAH05 General Lines - Life, Mishap & Health 2 hrs 30 min 125 25 150 InsTX-PC06 General Lines - Home & Casualty 2 hrs 30 minutes 125 25 150 InsTX-Life01 Life Representative 2 hrs 85 15 100 InsTX-PersPC55 Personal Lines 2 hrs 100 16 116 InsTX-ALAdj16 Adjuster - All Lines 2 hrs 30 min 150 0 150 InsTX-PCA81 Adjuster Home & Casualty 2 hrs 30 minutes 150 0 150 InsTX-LHIC42 Life & Health Insurance Counselor 2 hrs 30 min 150 0 150 InsTX-LL93 Limited Lines Agent 60 min 50 0 50 Fingerprinting is available at the testing center.

identogo.com or on the phone at (888) 467-2080. You can obtain your license 24 hr after passing the exam by completing an application at www. sircon.com/texas. The application procedure need to be finished within one year of passing the examination or the exam need to be retaken. A - how to become independent insurance agent.D. Lender & Company supplies licensing information as a courtesy to our trainees.

The Facts About How To Become An Insurance Agent In Illinois Revealed

A.D. Lender & Business offers no guarantee of the accuracy of this information and will not be held responsible in case of noncompliance with the license requirements. Was this post helpful? Yes No Sorry about that What can we do to improve? Send Thank you for your feedback!.

With numerous various types of insurance out there, it's no wonder that the variety of insurance coverage laws keeps increasing. One of these laws, which varies by state in its details, needs anyone wanting to offer insurance coverage to very first become accredited in their state. However what does it require to end up being a licensed insurance agent? Once again, the specific requirements are various in each state, however this post lays out a few of the common prerequisites, including the background check, insurance training courses, and the licensing examination.

Many individuals rely on these services to provide a crucial safety web for anything from small minor car accident to ravaging natural catastrophes or serious health problems. Therefore, it's easy to understand that states try to secure consumers by requiring a background check and minimum education requirements for insurance representative hopefuls. Some states go further, mandating candidates go through fingerprinting in order to analyze their state or federal criminal history.

In terms of minimum education requirements, most states are pleased if you have at least a high school diploma. Nevertheless, numerous employers will businesswire.com/news/home/20191008005127/en/Wesley-Financial-Group-Relieves-375-Consumers-6.7 wish to see a college degree as well. Courses in finance, organization, and economics, in addition to experience in sales are handy when seeking work later.

The smart Trick of How To Be An Independent Insurance Agent That Nobody is Talking About

You'll first require to choose what kinds of insurance coverage you wish to sell, such as life, health, or property and casualty insurance Hop over to this website coverage. Then, consult your state's department of insurance to get a list of approved and required courses and course service providers. State laws will vary with regard to the number of course hours you'll need to finish and the timeframe within which you'll need to get it done (for example, 40 hours of coursework within six months).

After you submit your licensing application and finish the pre-requisite training, you'll have to pay a fee and register for your state's licensing test. Study products and information about what's tested can often be discovered on your state's department of insurance coverage site. In addition to concerns concerning the exact types of insurance you're wanting to sell, examinations will test your knowledge of insurance coverage fundamentals, rules, and regulations.

If you stop working, you should inspect your state's rules for when you can retest or how you may tackle appealing the results. For example, in California, if you stop working 10 times in a 12-month duration, you'll need to wait 12 months prior to retesting. When you pass, you can finally call yourself a licensed insurance coverage representative, though you'll still require to finish continuing education to regularly renew your license.

Whether you're an experienced license insurance coverage agent dealing with a tough legal concern, or you're an applicant who's hit some legal roadblocks to acquiring your license, let an experienced legal expert discuss the appropriate insurance coverage laws and assist you resolve your problem. Contact a local insurance lawyer today to get help defending your interests.

How How To Become An Independent Insurance Agent For Progressive can Save You Time, Stress, and Money.

Insurance agents can come from all types of academic backgrounds. In lots of cases, representatives can qualify for tasks with just a high school diploma, but some companies choose a college degree. Completing a degree in service or management, for example, can be great preparation for a career in insurance sales, since graduates will recognize with principles of marketing, economics, and finance.